40+ does your mortgage include property tax

Web There are two primary reasons for this. Web When do you pay your property taxes.

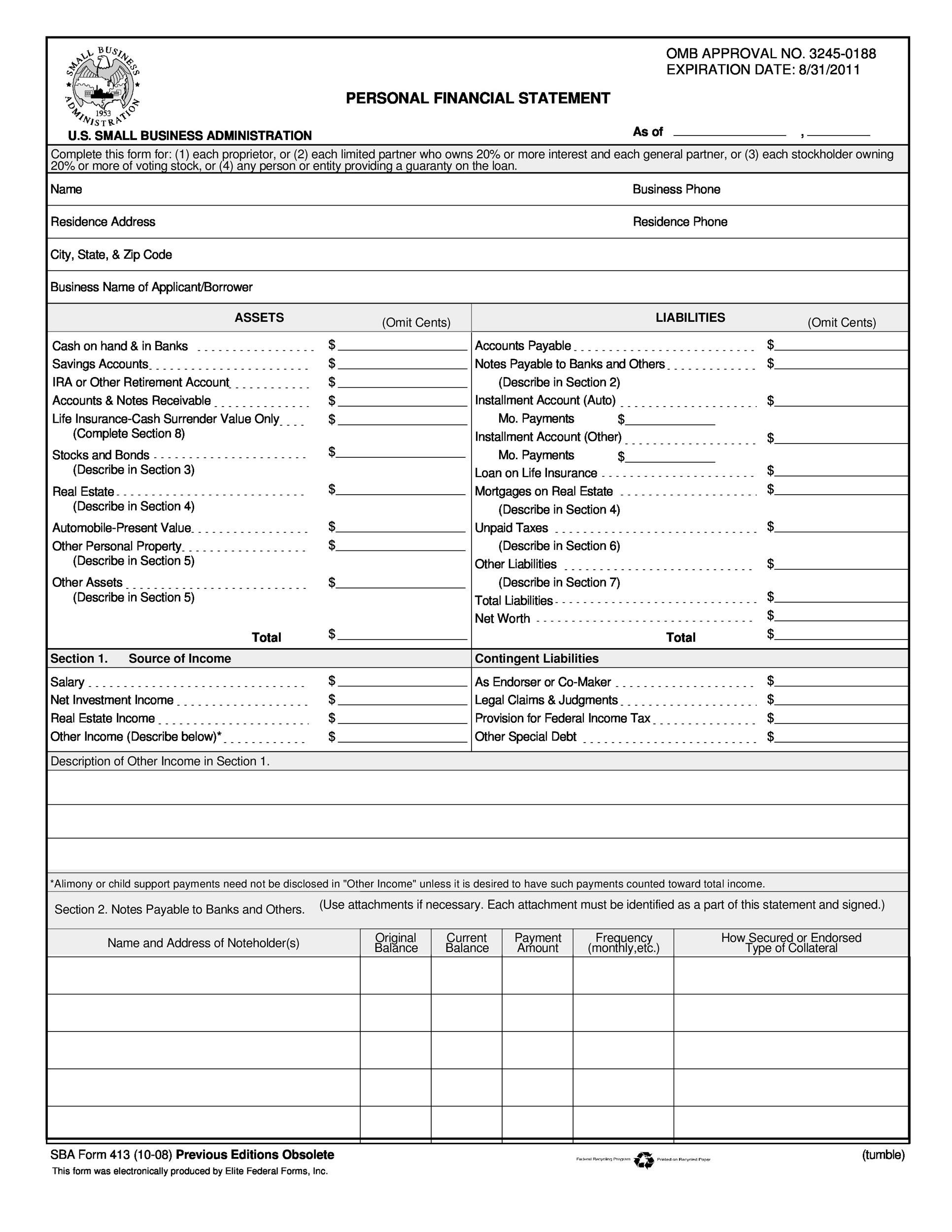

40 Personal Financial Statement Templates Forms ᐅ Templatelab

Web The Conservative Model.

. Web If you have an escrow account homeowners insurance is included in mortgage payments along with private mortgage insurance and property taxes. The assessed value of the home. Debts that count toward your.

25 of After-Tax Income. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly. Youll just need some information.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. While your local government charges property taxes every year you can pay them as part of your monthly mortgage. Ad Calculate Your Payment with 0 Down.

Compare Lenders And Find Out Which One Suits You Best. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Home loan payments including principal.

Compare Lenders And Find Out Which One Suits You Best. At closing the buyer and. Web For example if your monthly pre-tax income is 5000 and you have 2000 worth of monthly debt payments your DTI is 40 percent.

Web All you have to do is take your homes assessed value and multiply it by the tax rate. Ad 5 Best Home Loan Lenders Compared Reviewed. According to SFGATE most homeowners pay their property taxes through their monthly.

Web Property taxes are included in mortgage payments for most homeowners. On the flip side debt-despising Dave Ramsey wants your housing payment including property taxes and. Web Your adjusted basis is generally your cost in acquiring your home plus the cost of any capital improvements you made less casualty loss amounts and other.

First if you have a down payment of less than 20 you wont have enough equity in your home for your lender to consider. Comparisons Trusted by 55000000. Lets say your home has an assessed value of 100000.

The property tax percentage. Web What You Need To Know. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

Web The amount you owe in property taxes is fairly easy to calculate. If your county tax rate. Comparisons Trusted by 55000000.

Web DTI is calculated by adding up your monthly debt payments and dividing them by your gross pre-tax monthly income. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Looking For Conventional Home Loan.

Ad 5 Best Home Loan Lenders Compared Reviewed. Looking For Conventional Home Loan.

2995 Day Road Gilroy Ca 95020 Compass

Independent Houses In Sector 40 Gurgaon 40 Houses For Sale In Sector 40 Gurgaon

Property Taxes Your Mortgage

All About Property Taxes When Why And How Texans Pay

How Much Should I Have Saved In My 401k By Age

Are Property Taxes Included In Mortgage Payments Smartasset

Heritage Home Loans Hhlnorthwest Twitter

How Much Should I Have Saved In My 401k By Age

Canadian Mortgage App Apps On Google Play

Anmeldung In Berlin The Only Guide You Ll Need Nomaden Berlin

I Overpaid Property Taxes For 40 Years Can I Get My Money Back Nj Com

How Property Taxes Are Calculated

Escrow Taxes And Insurance Or Pay Them Yourself

Property Tax Calculator Estimator For Real Estate And Homes

Top Real Estate Agents In Vaughan Wowa Ca

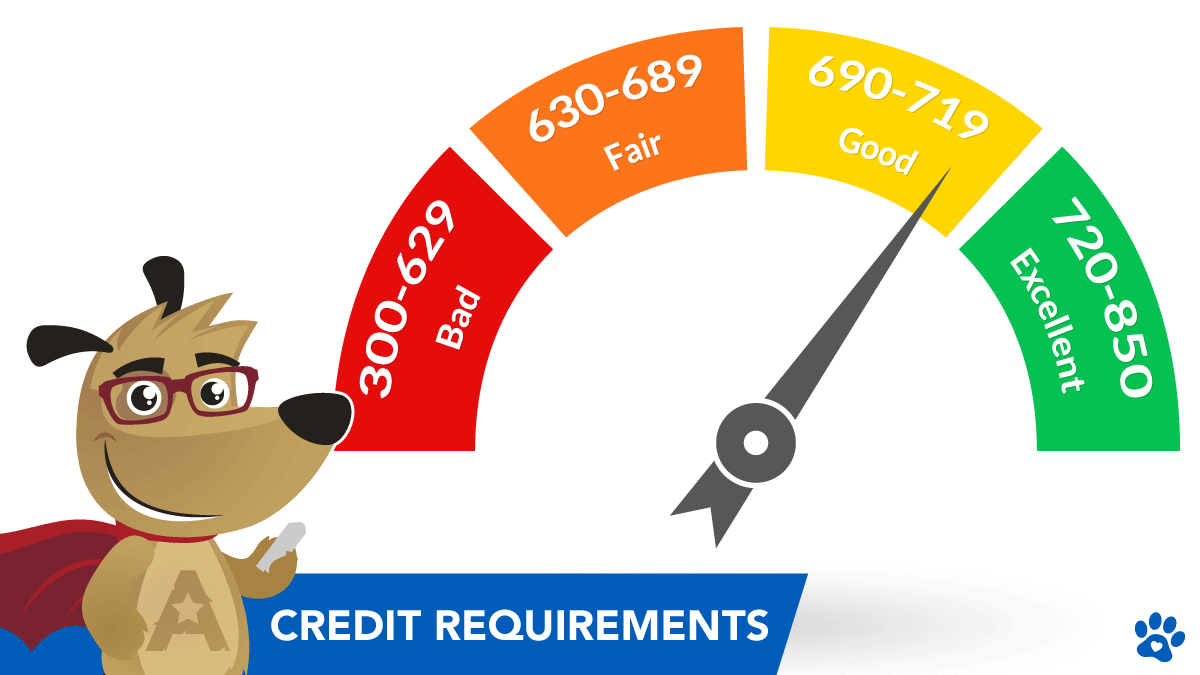

Credit Requirements For A Reverse Mortgage In 2023

48 Real Estate Terms To Know Real Estate Glossary Vocabulary